The downside (and benefit) of investments measured in real time means there are ever-present signals that generate real time reactions and real time emotions.

When markets are moving upward the signals are positive and investors exhibit a sense of ambivalence because that’s what they invested for, right? When they are moving downward there’s a sense of fear, terror and possibly end of days because if the market is signalling anything, it’s more of the same, right?

After some markets had their worst weekly start to the year ever, the media started reporting with an ominous tone. To them it was some type of signal, but by the end of January it wasn’t quite as bad as expected.

The ASX 300 was down 3.2%, but still not even close to the worst January ever. Meanwhile in the US the S&P 500 did have a poor January, but it was only the ninth worst since 1926. And while that might be enough to have investors manning the lifeboats, if they’re actually looking for signals, a negative January has been followed by a positive year 59% of the time.

The storm of January also had investment bank Goldman Sachs signalling they’d got it wrong – revising five of their top six predictions for 2016. Again, this might sound like an ominous signal, but only if you placed any significance on Goldman or anyone else’s predictions in the first place.

To some investors, or those in the media, rough market periods signal it’s time to again listen to those bearish voices who’ve told us for the last five years that the next market crash is just around the corner. They may be right, but they don’t suddenly deserve credibility if they’ve been wrong for the last 259 weeks straight.

These types of signals do overwhelm some investors. There’s that gnawing feeling they should be in cash, at least until they get the signal markets have settled (in their mind) and it’s safe to invest again.

Yet pulling the pin means they’re signalling they know what’s coming next, prompting the first question: if their signals are so good why didn’t they know about this turbulence before it started?

Pulling the pin also means forgetting the idea of investing was to have more money and income in years from now. Something that’s not possible by using the bank that offers zero after inflation and tax

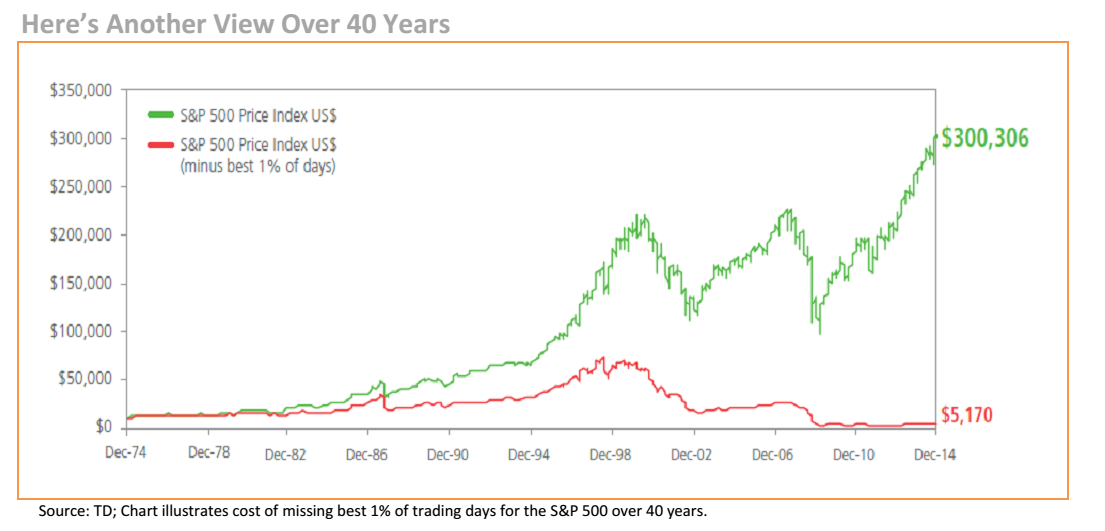

Fear signals are a costly thing. In the past you’ve probably seen charts that highlight how markets move sharply upward in short spaces of time, proving market time is a costly exercise. Missing the best 5 to 25 days during a 20 year period has shown to negatively impact returns on a share index by 25-70% in the US and Australia.

Well here’s the most damning indictment of market timing yet. Forty years on the S&P 500. The green line is buying and holding. The red line removes the best 1% of days of market returns during that 40 years.

Miss 1% of the best days and an investor potentially misses 98% of the returns.

Surely a signal to accept volatility and wait for the benefits those 1% of best days bring.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.