“He can’t figure out why it’s taking so long to reach the amount he wants to retire on.”

It was an offhand comment a client made about their friend. Said friend had a specific final superannuation balance in mind they wanted to reach. Upon hitting it, they’d be tossing the keys back to the boss and blazing off into the sunset. Yet it had been slow going and despite assuming he’d be there by now, the magic figure had proven elusive.

Welcome to the wonderful world of age based investment stages. It’s a world where you can keep working, your contributions continue to flow into you super fund, but the growth slows as you age, and that ideal balance is harder to reach.

The client’s friend hadn’t understood that his set and forget mentality combined with the default investment option at his super fund had locked him into automatic changes to his asset mix as he was aging.

Take the default investment option at many of the industry super funds. When you hit a specific age i.e. 50, 55, 60, your asset allocation will automatically become more conservative. This is designed to protect account balances from volatility as the fund member gets closer to their retirement age.

A good idea for the more skittish investor, but there’s a potential trade off where the investor likely forgoes higher returns. It also doesn’t take into account an individual’s circumstances. This is a bad thing if a person’s engagement with superannuation is limited to knowing their balance and knowing when they want to retire – the two may not meet when expected.

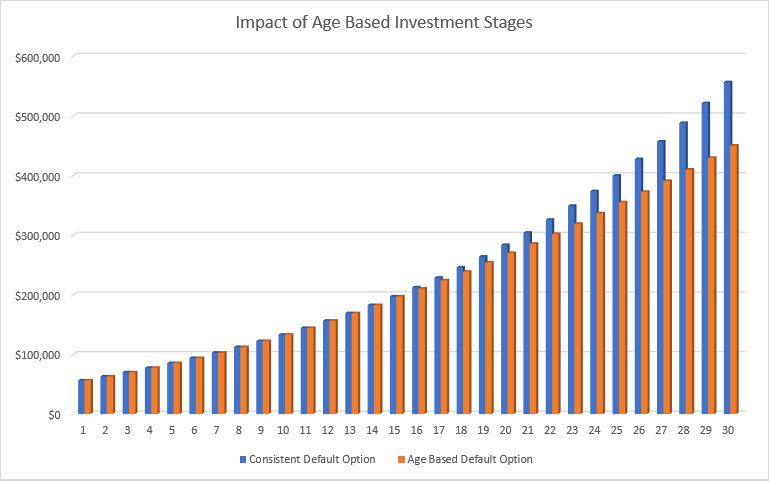

The impact of age based investment stages is shown in the chart above. We’re assuming both options start with $50,000. For simplicity the contributions remain static at $3,000 per annum. Until the 15th year both options enjoy an average annual return of 6%, but from years 16-20 the orange account only achieves a 5% return, in years 21-25 it achieves a 4.5% return and in years 26-30 a 4% return. At the same time the blue option continues to achieve a 6% return.

These figures are similar to the return assumptions super funds using age based investment stages make. As the chart shows, if you’d been aiming to retire with $500,000 in 30 years, but after 15 years your asset allocation was slowly becoming more conservative, the odds of you getting there aren’t good. In fact, you’d need another three years to get there and another five years to surpass the $556,000 balance the blue option reached in 30 years.

Age based investment stages also present problems if your preferred retirement age is further down the road or you’re wanting a higher income in retirement. If your intended clock out is in your 70’s and there’s a minimum of 20 years up your sleeve, becoming more conservative at 50 may not be appropriate. Similarly, that bigger balance to draw upon won’t be forthcoming without higher contributions and higher returns. Higher returns aren’t likely if your asset allocation becomes too conservative.

It’s a simple risk reward equation that’s often lost on the average investor, but on this occasion, it’s lost on them because they don’t know about it.

Another unheralded benefit of getting advice.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation, and individual needs.

#investing #financialadvice #retirement #smsf #martincossettini #bluediamondfinancial