Neil Woodford has a neck thick like a rugby player and a head shaped like it was chiseled out of granite, it could be mounted somewhere on Easter Island. Imposing is an appropriate word to describe his appearance. Woodford is a man screaming conviction.

Charlie Aitken is almost the opposite, but no less memorable. His features are sharp, he’s thin. Hair slicked back, often wearing a smug smirk; he appears supremely confident, giving the impression you should be listening to him. Aitken is a man screaming conviction.

While Woodford looks like he could be cracking heads outside a nightclub and Aitken cracking jokes on a late-night talk show, they’re both in the same business. They both manage money and lately, it hasn’t been going so well.

Woodford was known as a star stock picker during his time at UK investment manager Invesco, so in 2013 it was time to set up his own fund. He started off strongly.

In his first full year on his own, Woodford’s flagship fund returned 16 percent, beating all 50 of its peers tracked by Bloomberg. That has all changed, with the fund down 7 percent this year through May 31 and down 18 percent in the past 12 months.

And those falls have caused panic with Woodford’s investors.

Neil Woodford’s problems are a fund-management version of that old-fashioned bank run. Investors in the Woodford Equity Income fund have been asking for their money back at a rapid rate – about £10m a week. Unlike a bank, the fund has all the money – but it is invested in a series of companies.

To come up with the cash at once, the fund would be forced into a fire sale, with the result that investors would almost certainly get back less – much less – than they put in.

To stop the rot, this week Woodford suspended trading in his flagship fund in the UK.

Back in Australia, Aitken was one of Australia’s better-known stockbrokers before he made the leap to start his own fund in 2015. He attracted high profile investors such as billionaire Kerry Stokes and was said to have $300 million in funds under management. The fees were 1.5% and 15% of any outperformance over the fund’s benchmark.

Aitken’s Global High Conviction Fund started off promisingly enough. It outperformed its benchmark, the MSCI World Index, until 2018 when the fund fell almost non-stop throughout the year.

Aitken Investment Management’s Global High Conviction Fund suffered a 23.8 percent loss in 2018 after being defeated by macro conditions that undermined the strategy’s pro-Asia bets.

This year it has lost further ground as the MSCI World’s recovery has been much stronger than that of Aitken’s fund. With that stinker of a return fresh in the memory, things are also happening at Aitken’s fund. The biggest investors apparently want change.

Rather than expand the stock-picking team, we’ve heard the telegenic Aitken — we gather after some nudging by Stokes and Rankin — is going to recreate the business as a branded global index fund, with some high-conviction calls on the side.

Sounds like a fund available for 0.3% from a regular fund manager. Unless the pencil is sharpened on fees, any investor will pay Aitken an extra 1.2% for a little speculative indulgence. Hardly seems warranted.

Both Woodford and Aitken are known as conviction investors, but there is a problem with convictions. When you have convictions, investors expect your convictions to be right and they don’t give a damn about your convictions when they’re wrong. They have zero patience for theories on why something should have happened and yet didn’t.

They don’t want to accept a financial crisis type return in a year when there’s no financial crisis just because something happened in Asia or Europe that you didn’t foresee.

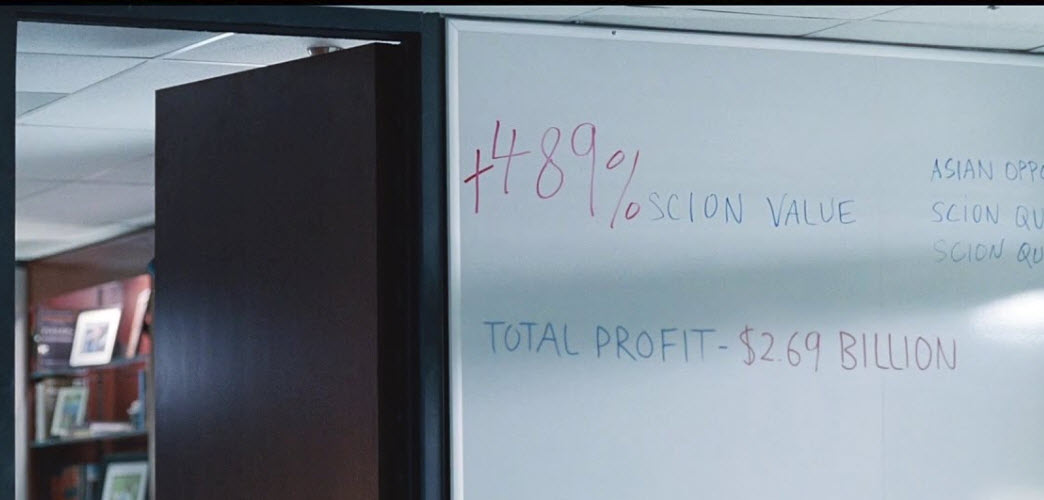

One of the more famous conviction stories is that of Michael Burry. It was memorably featured in the film The Big Short. Burry (played by Christian Bale) bought credit default swaps on subprime mortgage bonds. Doing this ensured Burry’s hedge fund performance was terrible for a considerable period of time due to the cost of holdings the swaps.

His investors were frustrated at the returns and apoplectic when Burry suspended redemptions and froze his investors’ capital until he believed the CDS market was acting as it should. If you’ve seen the film, Burry continually writes the percentage decline of his fund on a whiteboard.

In the end, the payoff was spectacular. The number Burry finally wrote on his whiteboard was a two-fingered salute to anyone who doubted him.

Michael Burry’s final return.

While it’s a great story, it’s not particularly helpful for everyday investors. In the film, the audience is meant to sympathise, and cheer Burry on. In real life, the audience would be the investors screaming at Burry demanding their money back.

And for every Michael Burry who survived, recovered and delivered a monster pay off, there are an array of funds that have been shuttered after abysmal performance, the managers slinking off into the night. If an investor is down 20%+ in a fund based on a manager’s convictions, you can be assured they’re losing their convictions in the manager’s abilities.

Neil Woodford has been great in the past. Charlie Aitken has been great in the past. As we see time and again when it comes to investment returns, reputations mean nothing. Investors banking on previous conviction success won’t know the manager they’re investing with is right or wrong until after the fact.

Not that it stops the media giving them endless free publicity. Both Woodford and Aitken have been media darlings in their respective counties. In many investors’ minds, media exposure equals skill and legitimacy when it’s only an indicator of the past and a willingness to provide a colorful quote.

But here’s a more important quote from some investors in Neil Woodford’s fund, “we trusted Neil Woodford with our money”.

Investors can trust a person, or they can trust capital markets and the factors that are known to drive returns. There are no guarantees, but in the past markets have been able to price in bad news and eventually keep providing returns.

The same can’t be said for every star manager’s fund.

Neil Woodford explains to his investors.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation, and individual needs. #investing #investments #retirement #retirement planning #smsf #wealth creation #martincossettini #bluediamondfinancial