Welcome to our latest COVID-19 update.

Firstly, some positive news. Locally it has been encouraging to see compliance with the government’s social distancing rules. We’ve been in regular contact with overseas colleagues in the US and New Zealand. It’s pleasing to hear people understand the importance of keeping the spread of COVID-19 under control.

The research on a potential vaccine continues and there have been hopeful developments. From the University of Pittsburgh.

Scientists at UPMC and the University of Pittsburgh School of Medicine have announced a potential vaccine against SARS-CoV-2, the new coronavirus causing the COVID-19 pandemic. When tested in mice, the vaccine produces antibodies specific to SARS-CoV-2 at quantities thought to be enough to neutralize the virus.

From biotech company CytoDyn.

An experimental HIV drug that has been used to successfully treat COVID-19 patients is in its second phase of testing with the Food and Drug Administration and could potentially be approved for use in four weeks, its manufacturer says.

On the government response, it’s been pleasing that governments and central banks around the world have done their best to offer a response that may mitigate the economic fall out as much as possible. No stimulus will or can be perfect, and there will be economic casualties. This is the reality, as it is in every downturn. There is big talk about needing to be more self-reliant in the aftermath. Encouraging more manufacturing and infrastructure projects to stimulate and support employment. Whether this proves to be the case, we’ll have to wait and see. Doing more to encourage our productive capacity and less to encourage speculative borrowing to bid up house prices wouldn’t be a bad thing.

Markets & Evidence

The investment markets haven’t been pretty, but we’re pleased to see our beliefs are working. We have an investment philosophy document. It’s detailed. It references academic science. It’s put together so there is a set of guiding principles around how your portfolio is constructed. It only operates on demonstrable evidence. Every historical market situation forms that evidence. It can’t control or predict markets. No one can. Based on what we know, portfolios and the asset classes that comprise them are behaving as they should.

More aggressive portfolios expect more volatility, they’re seeing it. Less aggressive portfolios expect less volatility, they’re seeing it. This consistent behaviour has also been present in the recent recovery. No surprise to us.

We don’t want to be in the business of opportunism, but there are many investors and non-evidence-based advisers out there who are now learning things about their investment portfolios as this situation evolves. That is never a pleasant situation to be in. It is one we avoid because the risks in our portfolios are well understood. We built a process a long time ago to ensure we understood the behaviour of the asset classes and the funds we use.

Throughout history markets have recovered. Many specific products and strategies have not. The investors who will face the most problems as the effects of COVID-19 continue to work their way through the financial system will be the ones who don’t have a legacy of evidence behind their portfolios. Mortgage funds. Dividend chasers. Illiquid assets subject to redemptions. Speculative property investments.

Behaviour

Mindset is important during a time like this. Remaining calm and remaining positive remains important. There are always two schools of thought on where we are heading, and beliefs can fluctuate. Gauging the investment mood can only be done on a limited observational basis, but there are some interesting and expected behaviours occurring.

The flood of calls to superannuation funds has been noted as mostly unadvised investors in a serious panic switching their investments to cash. We’ve noted the mood around internet investment forums. Frightened talk about depressions. DIY investors panicking, asking what they should do. Outsourcing their decision making to the wisdom of the crowd.

Well known Australian fund manager Magellan reported their assets under management at the end of March. As expected, their assets were down because markets were down, but they also highlighted their inflows and outflows. The retail or the average investor were net sellers during the month, with $303 million leaving. In contrast, institutional or professional investors were net buyers, with $772 million coming in.

In respect to our own experience and those of our colleagues, both here in Australia and overseas, there has been a marked difference from some of these observations. Advised clients, which includes yourself, have shown remarkable consistency in their behaviour. Very little panic. Significant resolve. For some, a notable interest in making investment contributions. We’d hope this considered approach, observed across a deep cross section of clients across various countries, shows the benefit of partnering with an adviser who can offer perspective at times like this.

The Recovery

There’s no forecasting in our process so we’re not going to enter into where markets sit right now. It has been pleasing to see a recovery since the lows of March. This again highlights markets can move incredibly fast.

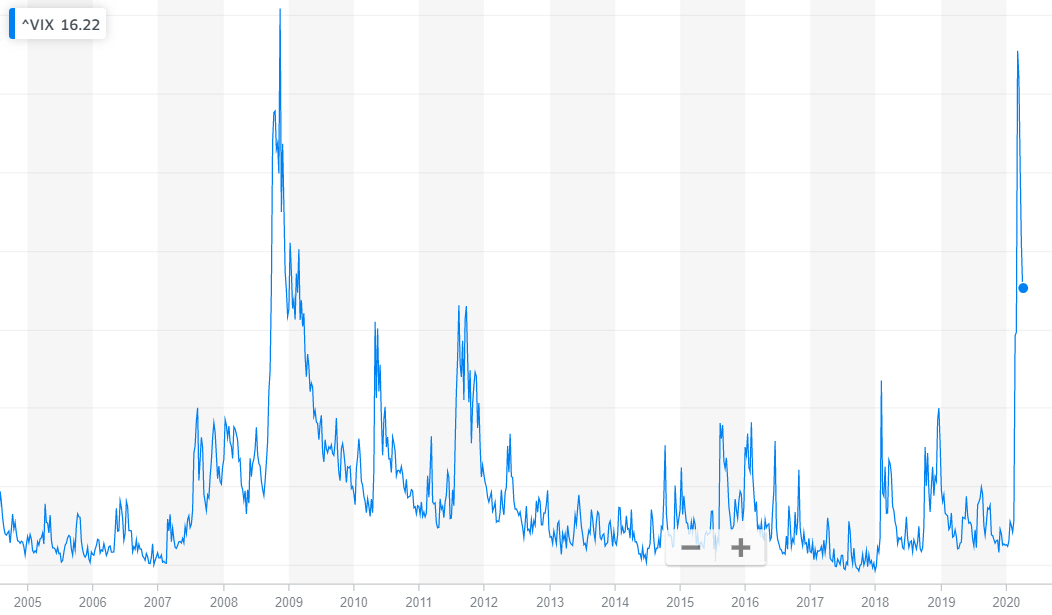

There are some interesting points to note. The Vix index or fear index spiked massively in March. The below chart shows a comparison between 2008 and March 2020, however it’s measured on a weekly basis and doesn’t quite do the most recent spike justice. On a daily basis, the index was actually higher than in 2008. Since March 17 it has dropped by half.

The All Ords have clawed back 15%, the S&P 500 is up 22%. All this while economies have shuttered, and millions are unemployed. It seems confusing, but markets don’t necessarily focus the now as much as they focus on the future. They are sensing there is a way out. There will be plenty of bad days ahead, but the restrictions seem to be working. With containment, will likely come ongoing testing and observation. You shouldn’t expect a return to normality for a while, but when it comes, it will come with pent up demand. There’s all of that stimulus to wash through. The urge to spend is unlikely to be suppressed in lock up and many people will have money landing in their accounts with significantly less opportunity to spend.

It should be noted that different hemispheres face different situations. Australia is heading into winter and we face challenges which may leave us under a higher level of restrictions than the Northern Hemisphere. That’s what six months of stimulus was for.

We remain optimistic, but this doesn’t mean there’s not the potential for more market turmoil. Millions will feel pain. Some of it will be self-inflicted. Those who thought debt was a replacement for savings and speculation a replacement for evidence. They will complain it’s unfair, but government won’t be bailing out everyone. This isn’t the end for society, democracy or capitalism. One thing will end: this pandemic.

Something to look forward to.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation, and individual needs. #investing #goals-based advice #investments #retirement #retirement planning #smsf #wealth creation #personal insurance #martincossettini #fiduciary financial advisor #bluediamondfinancial