The good thing about our clients is they often provide us with new ideas and different things to think about. There’s always a question. A scenario. A change in circumstances. A lifestyle challenge. A different behaviour. A new personality. Encountering different people and different situations broadens our scope. Hopefully it makes us better advisers. More experience benefits the needs of our existing and future clients.

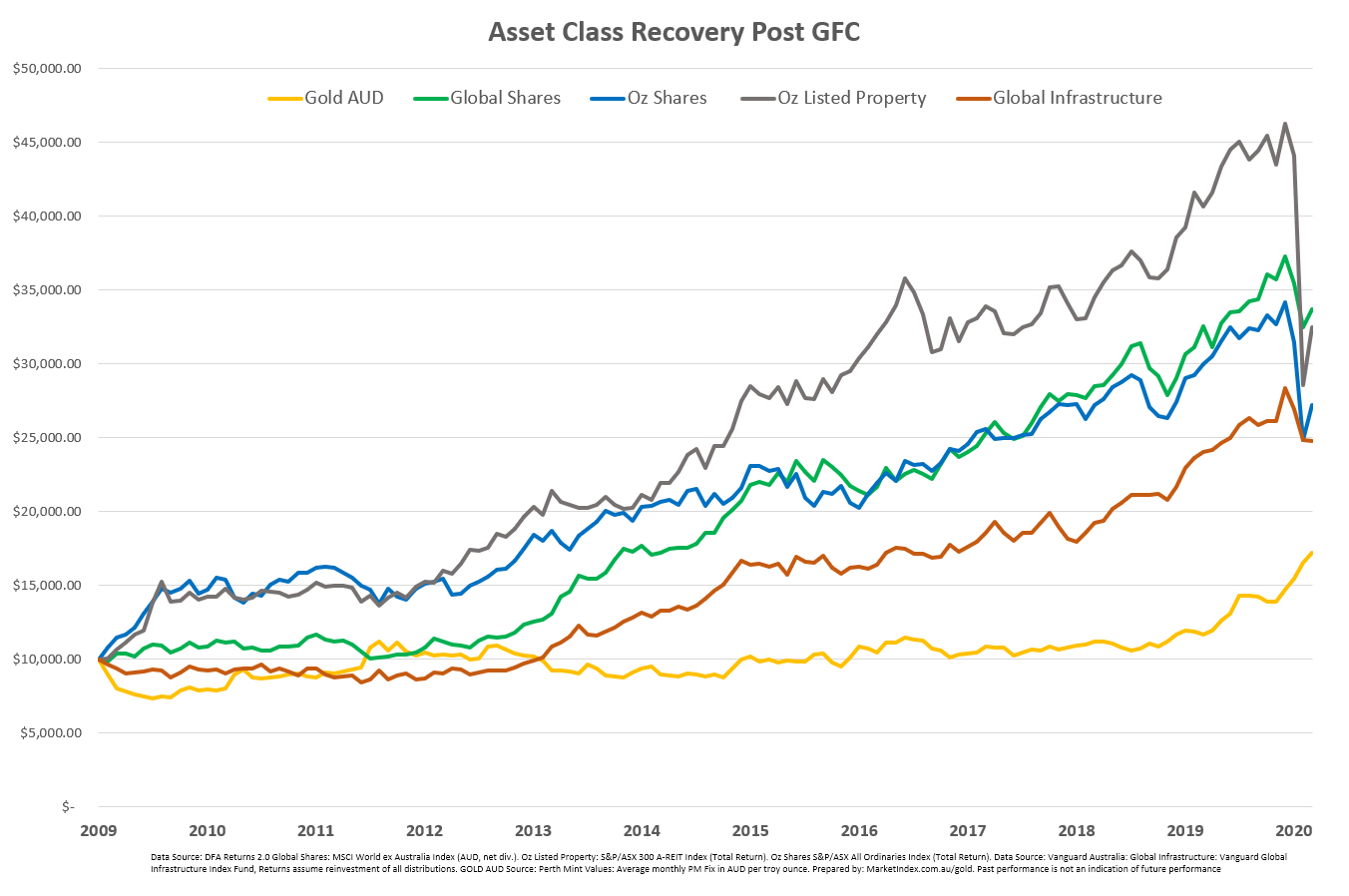

After our last story on gold, there were some questions. A couple of clients wanted to know more about winners and losers post the 2008 financial crisis. If we use sharemarkets as the measure, they bottomed in March 2009. Coincidentally also when a flood of money exited the market. It was almost the maximum pain point. To quote Scottie from Star Trek, for some it was a case of “I cannae take it anymore Cap’n!”. Then came a swift reversal.

Questions on how something performed generally have motivation. Often this is a two-pronged thought.

What if? & What next?

Human nature has us pondering both the past and the future. Two outcomes we really shouldn’t agonise over because we can’t control either. Setting aside those concerns, looking backward can be a fun and interesting exercise. If you can source some properly curated investment data. Getting your hands on properly curated investment data is hard.

Listening to an end of day media report for information? The market is back to where it was 18 months ago or 2015 or 2012 etc. It makes it sound like we’ve gone nowhere. Yes, markets can go backwards. But distributions often get reinvested. An investment grows. The guy on the news each night doesn’t highlight a growing portfolio or total return.

The questions we received were around various asset classes post the recovery. Gold. Sharemarkets. Listed real estate. Listed infrastructure. We don’t include listed infrastructure in portfolios. Specifically, they wanted to know what if we had added infrastructure and how did infrastructure perform? They’d heard infrastructure had done pretty well.

For comparison sake, the infrastructure here is represented by Vanguard’s Global Infrastructure Index Fund. There is also a hedged version of this fund. Across the time period both offered similar returns. The unhedged version we’ve used offered the best return.

If you like to play the hypothetical game of “what if I’d stuck all my money into X?”

There are results.

Listed real estate was the place to be right up until March. Then it suffered a serious fall. Under the set of circumstances commercial real estate currently is faced with, that type of movement isn’t a surprise. It’s tempting to increase exposure to real estate in a portfolio because it can outperform. The factors that lead to outperformance also lead to that large drop. Perspective is important. An Australian real estate fund may have 30-40 holdings. A global real estate fund 300 holdings. This lack of diversification cuts both ways.

Some investment circles consider infrastructure to be a defensive asset. We’re not coming to any conclusions based on this chart. All we can say is over the time period measured, it underperformed other listed asset classes. To answer the question about infrastructure doing well? It has done ok. Nothing spectacular. It can suffer a similar issue as listed real estate. A limited number of holdings in a fund determining performance. Quite often infrastructure holdings are low on capital growth, while distributions are doing the work.

And finally, gold. Certainly, it held its own in recent months. Even over the last 12-18 months it’s been great. There has been a price paid. Almost a decade of lethargy in its returns. Notably, gold is the only asset in the chart without a yield. There is no distribution to compound. It’s all price.

The winner over this arbitrary timeframe was Global shares. It wasn’t always the case. Sometimes it lagged. Lately, thanks to listed real estate’s fall from grace, it has triumphed. Like always, start and stop at a different time frame and it’s a different result.

That’s the past. And we can use it to guide our future. Not by speculating on the asset class that will be the winner or the loser. That we don’t know. But by acknowledging we don’t have the ability to predict market movements or forecast the next winner or loser. Constructing a portfolio from various asset classes and sub-asset classes give investors the best chance to capture gains when they appear.

Investing isn’t about making the leap to what you perceive to be the right asset at the right time. Quite often the timing is wrong and our perceptions don’t become reality. Hindsight then offers all the answers. Coming out of recovery, just like going into one, diversification and asset allocation will likely be the principles that work.

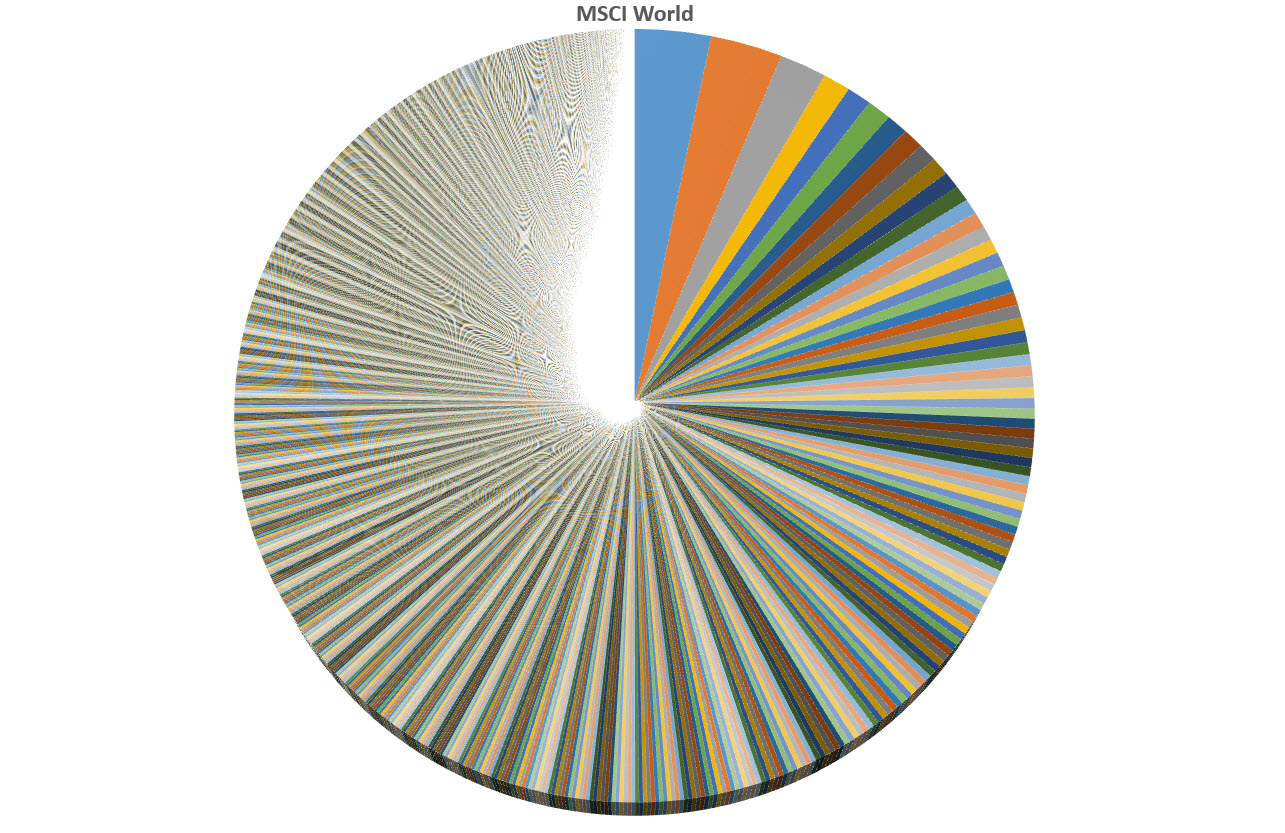

Finally, a brief note on diversification within funds. As highlighted earlier Property and infrastructure funds may only have a small number of holdings in comparison to a broader index fund. For interest, here’s a snapshot of a global share index. The MSCI World. 1643 holdings from the world’s developed markets. The largest blue slice is Apple.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation, and individual needs. #investing #goals-based advice #investments #retirement #retirement planning #smsf #wealth creation #personal insurance #martincossettini #fiduciary financial advisor #bluediamondfinancial