Tough to earn a buck for nothing these days. While that’s always been the case for our labour, there was always the illusion of some free cream from our money in the bank. Illusions, being illusions, this wasn’t strictly true. There was always tax and inflation nipping back any real return for doing nothing. Illusions are comforting though. If an investor thought they were getting a good enough return, then they wouldn’t go out of their way to chase one.

An RBA cash rate of 0.10% presents a whole new mind game for investors.

Some of the more opportunistic types in the investment space know it.

Over the last month, many people have drawn our attention to a whole bunch of new schemes and investment promotions that have sprung up like weeds.

They range from multiple property gurus and trading coaches standing in front of a whiteboard for a Facebook ad, to promotions of high yield investment funds from supposed ‘trusted’ investment commentators who should know better. Our old favourite, the whisky barrel scheme has even made a reappearance with an 8% pa ‘guaranteed’ return over a five-year term.

A quick trip down memory lane from the AFR.

As Mayfair 101 boss James Mawhinney paced the stage, he asked people in the audience to raise their hand if they were earning less than 3 per cent interest with their bank.

“Pretty much everyone,” he grinned, looking into the audience at Sydney’s Wesley Conference Centre last November. “If you’re earning more, I would like to know.”

Melbourne-based Mawhinney was presenting at the Switzer Income conference, hosted by the financial group of industry veteran Peter Switzer.

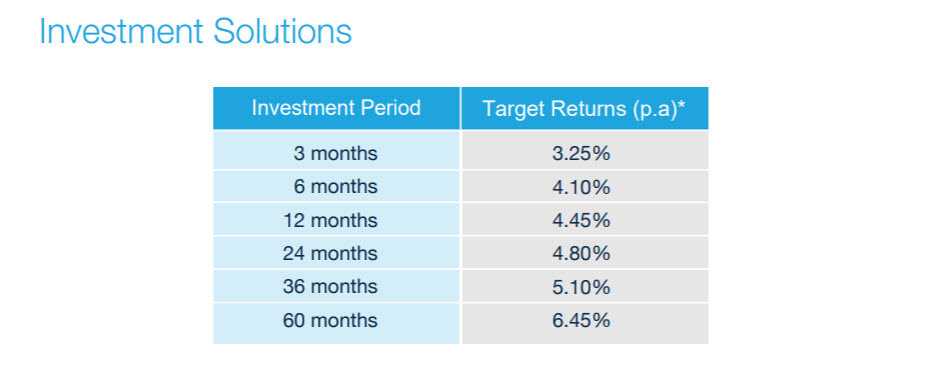

We wouldn’t want Peter Switzer to be left flapping alone in the breeze here. Alan Kohler also took time out to interview Mr Mawhinney. Mayfair 101 had an investment fund called IPO Wealth which was promoting itself as a high yield bank deposit alternative. The IPO Wealth fund failed earlier this year. ASIC alleges it hooked unsuspecting investors by cleverly invoking comparisons to term deposits. It even ran its own comparison website called Term Deposit Guide referring investors onto its own products. Against the bank, rates were decent as shown by the table below.

How did they generate these returns (before collapse)? Nothing remotely comparable to a bank or fixed interest product had you looked at the fine print in their marketing document.

The IPO Wealth Fund lends monies to IPO Wealth Holdings Pty Ltd trading as Mayfair 101 Holdings, a privately-held investment group related to the Investment Manager. These funds are used to facilitate private equity and venture capital transactions that it manages in a hands-on manner.

For an investor looking for low risk income, the last place they’d find it would be from a fund lending to a related party to invest in generally illiquid asset classes such as private equity and venture capital. And if you knew you were investing in these asset classes, you would damn sure want a better return than 4-6% per annum!

For the average investor, positioning these returns next to a term deposit or bank rates can be a signal. The investor will often do the shorthand, make the link and assume it’s as safe, just with better returns. However, quite often income products go well beyond this and use terminology that suggests safety and a lower risk profile.

Something ASIC warned about in May:

“Be wary of investments that claim to be ‘like’ a ‘term deposit’. Products spruiking even a two or three percentage point higher return than a term deposit represent significantly higher risk. We are also seeing products offering only marginally higher returns with much higher risk profiles.”

Before ASIC followed up with the findings of some surveillance work of investment marketing documents in September:

Out of the 22 managed funds, with over $15 billion in funds under management, that used the term ‘cash’ in their labelling, 14 funds had confusing or inappropriate labels. On average, funds labelled as ‘cash plus’ and ‘cash enhanced’ had more than 50% and 70% of their respective assets invested in assets other than cash or cash equivalents such as fixed-income securities and mortgages.

Most of those identified have taken remedial action to remove the offending statements. No doubt their marketing teams are already hard at work to find other terms that signal or suggest ‘safety’, ‘cash’ or ‘term deposit’. In other spaces, agricultural schemes will straight out use the word ‘guaranteed’ as they offer returns while slithering through the legal gaps of not being a financial product.

Many of the investors in IPO Wealth were snared by ads or by doing a google search for better returns while not taking any more risk. This is the problem. There are no higher returns without taking more risk. The defensive part of a portfolio has that name for a reason. It’s meant to be defensive. Income is nice, but in this environment, there is no way of generating it without extra risk.

The risk taken to generate income in some of these products pitched as defensive alternatives is much higher than it should be. In other words, investors are not being paid enough for the risk they are taking.

For DIY investors out there googling for their next return, they need to go past any headline numbers. They need to ignore signalling words. They need to find out what is exactly within the fund or product they’re itching to dump their hard-earned money into.

For investors with an adviser there’s a conversation about risk to be had. The risk-free rate of return is now pocket lint. Investors either accept this or if they want to pursue a higher return, they move up the risk curve.

The important thing for all investors is to clearly understand when they are moving up the risk curve. An adviser can have these conversations with an investor. A high-risk product promoting itself as a safe alternative will leave an investor to search for the truth. Usually in a 6-point font, on the last page of their marketing document.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation, and individual needs. #investing #goals-based advice #investments #retirement #retirement planning #smsf #wealth creation #personal insurance #superannuation #martincossettini #fiduciary financial advisor #bluediamondfinancial