Salary Sacrificing a Bonus

Awarded a bonus at work? Depending on circumstances, it may be worth salary sacrificing the bonus into superannuation. This can increase retirement savings & lower taxable income. The benefit depends on the difference between the 15% tax on super contributions and your marginal tax rate. Also, be aware of the concessional contributions cap of $25k (increasing to $27.5k on July 1).

Lump-Sum Contributions & Carry Forward Cap

If you haven’t used your concessional contribution limit of $25k and have money available to contribute, this is the opportunity. Further, if you have a decent sum of money available to contribute and your balance is under $500k the carry forward cap is also an option. For example, with $75k of space across three years, if your superannuation account received concessional contributions amounting to $30k across the 18/19, 19/20, and 20/21 financial years, there is $45k of unused concessional contribution space available.

Co-contributions

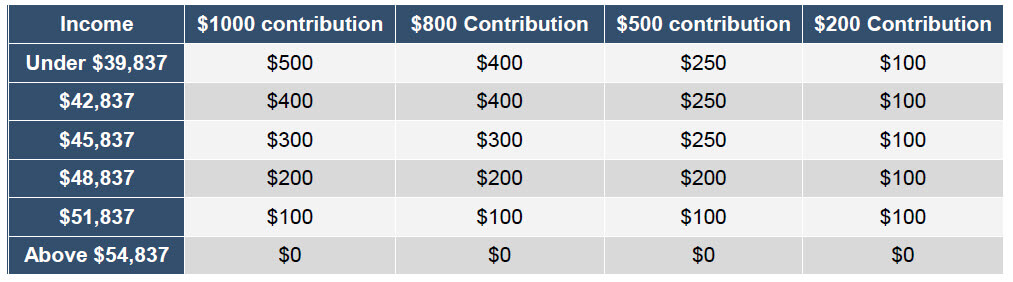

If you earn below $54,837, there is the opportunity to make a super contribution and receive a co-contribution from the government. The table below shows the potential scaling options.

Spousal Contributions

You can contribute to your spouse’s superannuation and receive an 18% tax offset on up to $3,000 when filing your return. The maximum tax offset is $540, on a minimum contribution of $3,000 and your spouse’s income needs to be under $37k. Above $37k there is a partial offset, but over $40k there is no eligibility.

Capital Gains/Losses

Been stock picking? Have some losses? You might be still carrying losses in your portfolio. Investors have a tendency to hold onto their losers in the hope of recovery, but sometimes it’s best to wipe the financial & mental ledger clean. Realising losses is especially beneficial if you have gains elsewhere you want to offset.

Annual Super Pensions Withdrawal Minimums

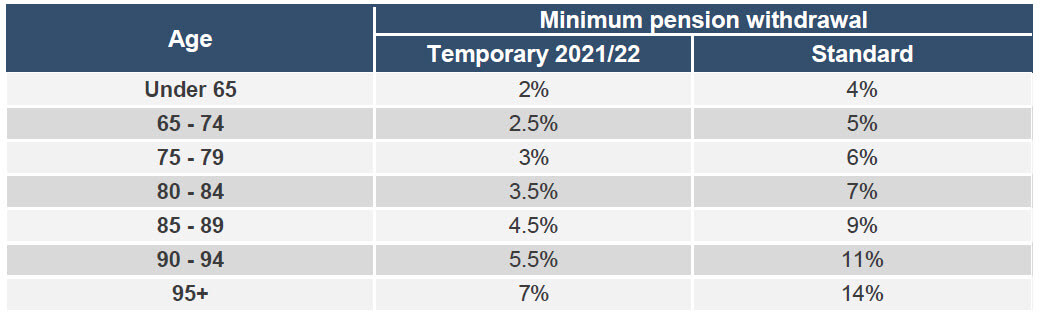

When a superannuant is in pension mode, they are subject to annual withdrawal minimums. These were halved due to COVID market volatility. Despite the market recovery, the government has extended the halving of withdrawal minimums into the coming financial year.

Annual payments are calculated on the account balance on July 1.

SMSF Pension Payment(s)

SMSFs may work on a single annual pension payment instead of multiple payments through the year and are often done manually. If this is the case, it’s important to ensure the payment or even the final payment is made before June 30 and that it reaches the minimum threshold for your age bracket above.

Bringing Forward Expenses

There is always the opportunity to bring forward tax-deductible expenses from the coming financial year, into this financial year. These include pre-paying investment loan interest, income protection policies, and private health insurance, and any work-related subscriptions or memberships.

Other Things to Check at End of Financial Year

- Are your beneficiary nominations current?

- Have you reviewed your pension payments and are they adequate?

- Have you collected your receipts for your tax return?

- Do you understand what deductions you can claim?

- Are you under or over your super contributions caps?

- If you are over 67, do you meet the work test for personal contributions?

As always, discuss all strategy options with your adviser.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation, and individual needs. #investing #goals-based advice #investments #retirement #retirement planning #smsf #wealth creation #personal insurance #superannuation #martincossettini #fiduciary financial advisor #bluediamondfinancial