Over the past decade, investing has become more accessible. Anyone who wants to do more than leave their money in the bank has an ever-increasing number of investment platforms to access financial markets. With the rise of exchange-traded funds (ETFs), investors can move beyond just stock picking to be broadly diversified or (more dubiously) target their hunches via thematic funds.

While all these options seem great for the novice DIY investor. They can soon prompt the paradox of choice. Stressing out over which platform to use and which funds to invest in.

What to do and where to turn?

Where better than anonymous people online!

If an investor is enterprising, engaged, not predisposed to whims, has the time, genuinely wants to do it, and are fully versed in what they’re investing in, DIY investing can be a worthy pursuit.

Some DIY investors can tick off all those requirements, but the last one often remains elusive. Being fully versed is unfortunately harder than most assume. When looking for where to start, DIY investors might get their first pointers from those anonymous people online. And while anonymous people sound confident because they might be more experienced, that doesn’t mean they’re fully versed. Their pointers are only ever what they do and what products they invest in, then they suggest the new investor do the same.

Positively, a lot of DIY investors have figured out the basics of keeping costs low by using indices. Often what emerges is a variant of the KISS principle (Keep it simple stupid) of portfolio management. The suggestion will be a combination of two index ETFs, one for Australian large-cap shares (VAS) and one for Global large-cap shares (VGS) or the VAS/VGS split. For the right person, this portfolio may well be the right strategy, but the person prescribing it has no idea who they’re prescribing it to. Worse, it can be followed by reckless comments such as “that’s all you need”, “safe choice” and “low risk”.

A new investor further examining the two ETFs in the portfolio would visit the product provider’s website and see the Australian side of the portfolio has returned nearly 9% annually since inception in 2009, while the global side has returned over 11% annually since inception in 2014. After hearing the words safe and low risk, and seeing almost double-digit annual returns on the provider’s website, the new investor could be forgiven for thinking what’s been suggested is akin to a deposit account that prints money. Even if an investor experienced the market plunge during the initial stages of Covid-19, they saw markets bounce rapidly. One might think that’s a given.

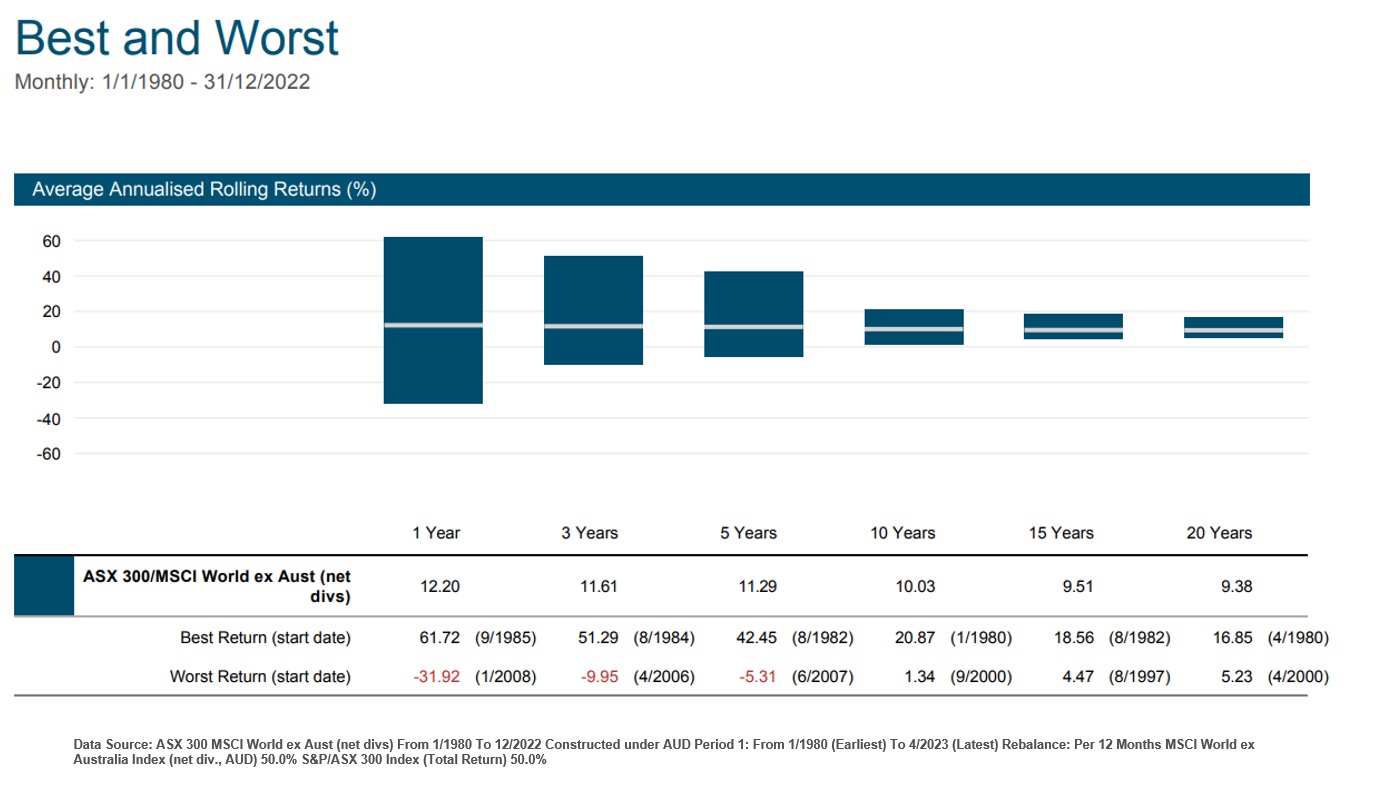

The unfortunate thing about investing from a DIY perspective is the lack of reliable data and tools for analysis. These things can offer a clearer picture of portfolio construction and historic performance. Specifically, the good, and the bad, that has previously been encountered. This is important because every investor should know what’s the worst that can happen. Not knowing leaves investors with a blind spot.

The indices behind these two large-cap ETFs were in existence long before the ETFs came along. In the years pre-2014, when an investor could first build the ETF version of what we’ll term the KISS portfolio, the outcomes were very different from what’s been seen over the past decade. The portfolio wasn’t a “safe choice” or “low risk”.

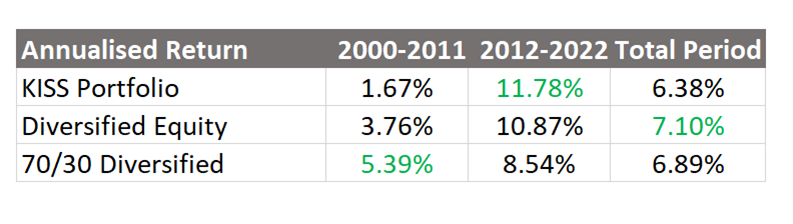

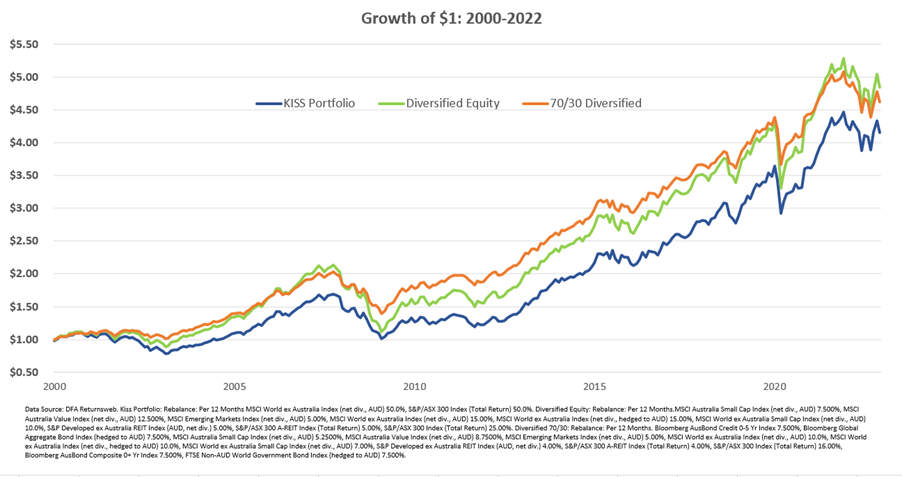

If an investor was to run the KISS portfolio, in this example, a 50/50 combination of the ASX 300 (Total Return) and MSCI World ex Australia (net, AUD) from the start of 2000 until the end of 2011, their return would have been 1.67% annualised.

The reason behind this terrible return was the extremely poor performance of the MSCI World ex-Australia Index. Cumulatively it was down over 35% from 2000-2011. The dot-com bubble, 9/11, the Iraq War, the global financial crisis and the strong Australian dollar toward the end of the period all played a role in destroying returns. The ASX 300 did its best with a 6.51% annual return, and it was just enough to keep the portfolio in positive territory.

What would happen if that portfolio was diversified a little more? Adding in some value and small-cap stocks, emerging markets, local and global real estate, and hedging the global large-cap exposure? These changes increase the annualised return to 3.76%. It’s not fantastic, but it’s a little more palatable than 1.67%.

Using that more diversified portfolio, what would happen if the risk was then dialed down, and its asset allocation was shifted to put 30% in local and global fixed interest, so it becomes a 70/30 growth/defensive split? These changes increase the return to 5.39% annualised. Still not amazing, but much better than a return starting with 1.

Is the 70/30 portfolio the best portfolio out of these three examples? No, it’s just a portfolio construction. Pick a different time frame and there will be different outcomes, as the table shows. From 2012 to end 2022 the KISS portfolio outperformed the other two. That doesn’t mean the KISS portfolio is the best portfolio either. Different portfolio constructions will perform differently, and their asset allocation will be the major determinant.

The best portfolio is the one built with the investor and their goals in mind. It’s also the portfolio that the investor understands and can stick with. If 50% of a portfolio is in one fund, and that fund goes on a decade plus long period, of not just underperformance, but significant loss, it materially affects the portfolio’s performance. It highlights there will be a benefit to being more diversified and having more non-correlated assets in a portfolio when times are tougher.

If concentrating their portfolio in two large-cap funds is a risk an investor is willing to take and they believe it will lead to a higher return, it’s not an issue. It’s important to be informed. If an investor isn’t aware of the downside and expects double-digit returns year after year, then they may find themselves frustrated and even give up after a period of underperformance.

Poor investment behaviour often starts with not understanding the potential for poor returns. Not understanding the range of potential outcomes and how portfolio construction makes a significant difference to returns, can mean setting someone up for failure. When it comes to inexperienced investors, portfolio construction certainly does matter.

Want to build a portfolio that works for you? Grab our book: Your Investment Philosophy.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation, and individual needs. #investing #goals-based advice #investments #retirement #retirement planning #smsf #wealth creation #personal insurance #superannuation #martincossettini #fiduciary financial advisor #bluediamondfinancia