It’s the most notorious name in the financial and investment world.

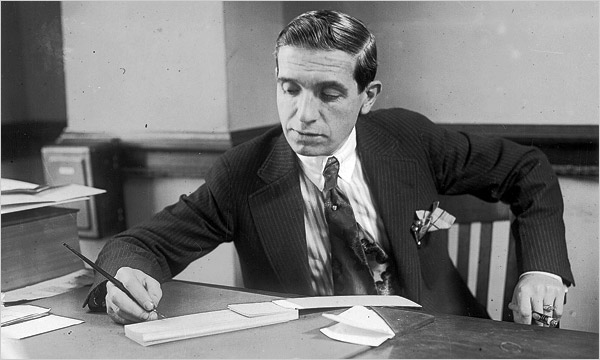

Ponzi. Charles Ponzi to be exact.

It’s nearly 100 years since Charles Ponzi ran his ‘investment scheme’, essentially described as an operator giving the appearance of generating returns by paying out old investors with money from new investors. The lure for investors is high returns with little volatility.

And nearly 100 years later, despite the notoriety of the name and the awareness we all should have, investors are still being taken in by Ponzi scheme operators.

The latest ‘alleged’ ponzi scheme blew up earlier this year in Sydney. Operating under the name of Courtenay House, investors were led to believe they were under the guidance of experienced foreign exchange traders. As always, investors were promised a fixed monthly return on their money, however in this instance operators built a little bit of risk into the marketing. Even ponzi schemes have wizened to the idea risk free returns aren’t credible!

There were three monthly trading categories: 1.5% monthly profit, which came with risking 4.5% of an investor’s capital; 4% potential monthly profit, risking 10% of capital; and 7% potential monthly profit risking 14% of capital.

The risks, it appears, were just for show, as an increasingly suspicious investor noted on an online forum a year before the collapse.

My main issue with them is that although they state in their contract that you are risking 10% of your capital per month, I have only been receiving steady profits, without once experiencing a losing month. I also have acquaintances who have been with them for 2 years and they also state that they have been receiving consistent monthly profits without once having a losing month. These people are in separate groups (within the same monthly trading package) which tells me that out of the approximately 7 groups in the same trading category as myself, 2-3 have been receiving consistent monthly profits over 2 years without a single losing month.

Despite their suspicions, that investor didn’t make any attempt to get their capital back. They later noted they were still ‘invested’ with Courtenay House up until the time Courtenay stopped all withdrawals – just before ASIC arrived on the scene.

Even worse, the investor was told by others on the online forum that what they’d described sounded very much like a ponzi scheme. Some nefarious parties soon arrived on scene to muddy the waters, claiming they’d been with Courtenay for a long time, it was all above board etc etc, then turning the discussion toward the idea the company and the investors’ money was insured by Lloyd’s of London and they were safe.

Clearly not.

How much had been invested, lost or stolen by the time ASIC swooped? $209 million, as little as $25 million has been frozen by ASIC in associated accounts.

Interestingly, Courtenay House also ran an investment fund which started trading in February 2016. This was actually a legitimate fund and its performance should have proven the biggest red flag to the investors who were handing over their money to receive the supposed fixed returns of 1.5%, 4% and 10%.

Known as the Courtenay House Capital Investment Fund, from February 2016 to December 2016 it lost over 75% of its value. This should have prompted the question – if their fund loses 75% of its value trading forex in less than a year, how can their unlisted forex trading continue to pay out uninterrupted positive returns to investors?

In the aftermath there were stories and deflections directed at those who’ve attempted to bluntly explain what’s happened: “ASIC are overreacting, Courtenay just need their license in order”, “the head trader was a good bloke”, “it’s easy to make 7.5% returns in a month, any pro can do it”.

These investors clearly weren’t past the first stage of grief – denial.

Some of the amounts invested with Courtenay House were truly eye watering. Many invested on little more due diligence than “a mate recommended them” or they heard someone was getting good returns and didn’t want to miss out. We’re continually highlighting these astounding scams and what else is there to say? As harsh as it is, sometimes a fool and their money should think themselves lucky they got together in the first place.

There’s no such thing as a guaranteed return, unless it’s bank interest. If anyone other than a bank is offering it, they’re likely a criminal.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation, and individual needs.

#investing #financialadvice #retirement #ponzi #martincossettini #bluediamondfinancial