It’s whiskey time again and for some investors across Australia the taste of this story is going to burn.

Previously we’ve noted the issues investors have had with Nant Whiskey and the follow up endeavour, Nant Angus. The lure was a 9.55% return “guaranteed” which was enough to get some investors to say “take my money”.

Some of those investors are now finding out that while Nant took their money, they didn’t bother to fill their barrels with whiskey – the same whiskey that was to mature in five years giving them a 9.55% return on their money.

And if you’re wondering what the return for those investors will be – 100% loss.

This has come to light because late last year Australian Whiskey Holdings (AWH) opted to acquire Nant’s distillery and Nant Estate in Bothwell. AWH have been doing due diligence and an audit of Nant’s whiskey stock and have been contacting investors personally with the good and bad news about their investment.

An early and extremely fortunate whiskey investor relayed us the details of his contact with AWH and what they found during their audit:

There have been more than 700 barrels sold to barrel investors but the barrels have never been filled with whisky and are not there. There are many more than this number still unfilled.

There are a large quantity of barrels which have been decanted, bottled and the proceeds sold however the barrel investors have not been informed or paid.

There is a large number of barrels that are filled with approximately 45% ABV alcohol new make whisky whereas the industry standard is usually 63.4%. This whisky will take longer to mature and develop complexity thus not maturing when investors thought it would in the normal range of 4-5 years and will be of a much lesser value to barrel owners.

There was a significant quantity of barrels that had the owners’ names and barrel numbers sanded off the barrels.

Finally, the CEO of AWH, who has been involved in the barrel audit, included this sobering detail in his email to barrel investors.

Today it was my deeply sad duty to inform one of the barrel owners that the barrels he had invested in have never been filled and don’t exist. You can imagine how difficult this phone call was for both of us. There are many more of these conversations unfortunately yet to come.

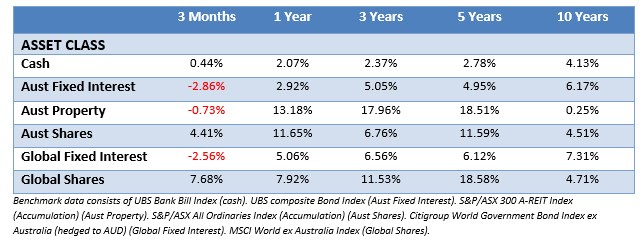

This time last year financial markets were just ending a rough market correction. It was enough for a jittery investor to query if Nant’s Whiskey scheme was a good option for their spare cash – our reply was an emphatic “NO”.

As we pointed out, Nant’s offer raised notable red flags when it came to investments.

Uses the word ‘guarantee’ somewhere – check. Uses a celebrity (Matthew Hayden) to spruik their wares – check. Offers a specific return well in excess of anything you’d receive from a bank – check. No Australian Financial Services License (AFSL) when offering what is essentially a financial product – check.

Nant is why we originally devised the path of the illogical and logical investor.

The illogical investor’s first step is to invest in something they don’t understand, often due to the promise of a great return. They then stumble across news that casts their investment in a different light, leading them to research it. What they find out leaves them in a panic and trying to reverse their mistake. Finally, their resolution is to invest “safely” by leaving cash in the bank. No capital growth with their money subject to erosion by inflation and taxes.

Contrast that to the logical investor.

The first thing the logical investor does is research. They ensure they engage with someone or something reputable, regulated and with a long-term investment process that doesn’t make promises. Only then does the logical investor invest their money. Inevitably their investment will hit volatility, but the investor understands this is a normal part of an investment journey. The logical investor enjoys reward over the long term because they’ve engaged in a process that has historically delivered returns in line with the level of risk they were prepared to take.

Whiskey, Tree farms, Ostriches, Angus cattle – what exciting alternative investments will we see next?