From international tennis stars one week to the average mum and dad the next.

The ABC’s 7:30 recently featured a story on victims of poor financial advice (investors duped by a noted investment spruiker) who are calling for reforms to protect anyone else from suffering what they’ve endured over the past decade.

Despite these investors being found to be eligible for compensation by the Financial Ombudsman Service, most of them haven’t seen a cent because those found to be at fault are either unwilling or unable to pay.

Those affected are calling for a fund set up to ensure losses are compensated. However, one of the sticking points is whether it should be retrospective to cover past losses or prospective to protect investors in the future.

Without debating the merits of any such fund, we will say in an ideal world we wouldn’t need any compensation fund because potential investors could spot terrible investments and those pushing them from a mile away.

7:30 has reported previously on the same spruiker who deemed himself a wealth educator. He was hosting ‘wealth seminars’ that cost $4000 to attend where he dispensed his secret formula to getting rich. The key points noted by investors in both reports were:

- They were told it was safe and they couldn’t lose money.

- They were encouraged to borrow against their home.

- They were encouraged to put in as much money as possible.

We’ll stop here for a few pointers. The first point should have been the immediate deal breaker, rarely does an investment come without some risk and any legitimate adviser would always look to spell out any risk to a potential investor.

Secondly, if an investor is encouraged to borrow against their home or put in as much money as possible, they should first understand that investment well enough to be able to then explain it confidently to someone else. The fact they proceeded after being told they couldn’t lose money is a clear indicator they had no idea about the investment path they were heading down.

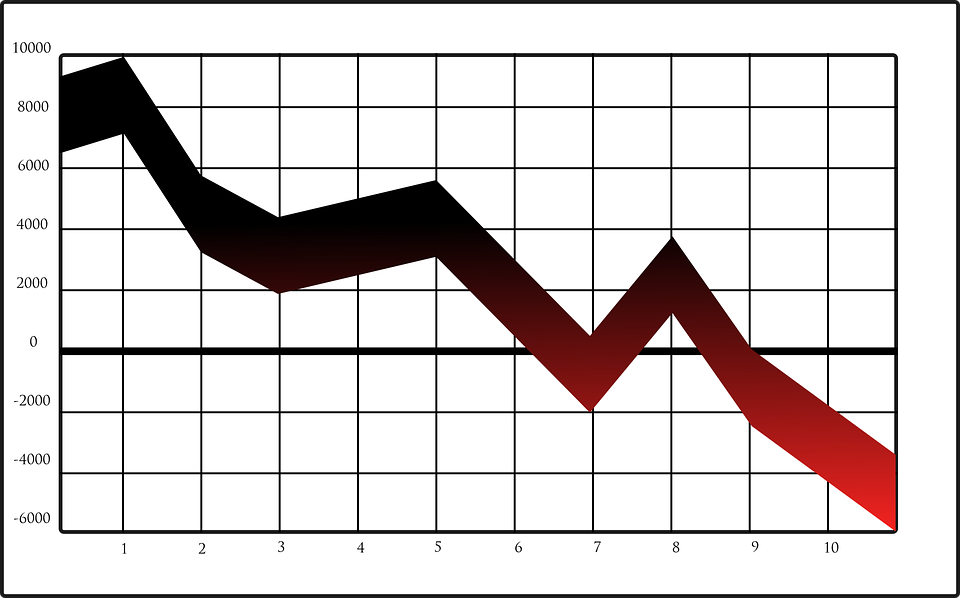

The spruiker was pushing high fee structured products (if you ever see those two words together – run!) that had redemptions suspended when the markets crashed during the GFC. As they’d geared into them they were left paying fees and interest with no access to their capital.

Some other key points noted:

- The spruiker was offering to turn the investors into millionaires.

- After the seminar, the investors felt they’d be crazy not to invest.

- They were encouraged to act quickly.

- They were told the investments would have less volatility than the sharemarket or real estate.

While we’re not unsympathetic to the investors and their plight, they do need to accept they paid $4000 to listen to a spruiker tell them they could become millionaires without taking any risk. The only way to become a millionaire with taking as little risk as possible is through buying a lottery ticket and striking it lucky. The downside risk there is $10.

However, realistic investing is a long-term process. Investments should align with financial objectives, it requires understanding risks (and personal risk tolerance), it requires consistent contributions, while maintaining discipline through times of volatility.

Finally, we’re not naming the spruiker because he’s an interchangeable piece. They all use the same language about safety, guarantees and no loss investments while promising life changing returns.

Every investor, regardless of experience, needs to recognise such language for what it is and walk away.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.

August 23, 2017